Attached a copy of the lobby pack that supports the Queen’s speech. Here are some…

COVID-19 Update 19th January 2021

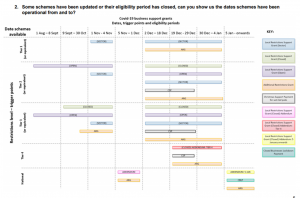

- BEIS FAQ to Councils on New Grants

I’ve attached a copy of the new FAQ that BEIS have produced for Councils on how to implement the new one-off Closed Business Lockdown Payment and the revised LRSGs that apply over the lockdown period. Apart for confirming which businesses are eligible (which frustratingly still excludes businesses in sectors such as coach and tour operators, language schools, event organisers, and contract caterers), there is a good chart in the document that explains what grants were available over which periods and in which Tiers since 1 August 2020.

One piece of the Guidance that is worth noting is Para 64 which relates to retrospective payments.

If a seasonal business was previously refused a grant because it was not open on the applicable eligibility date, but it continues to trade according to the trading indicators listed above, should the business be paid retrospectively?

Yes, as long as the business was not insolvent, in liquidation, struck off or subject to a striking off notice on that date, it can be considered to be trading and is therefore eligible to receive grants under this scheme. If seasonal businesses were previously refused grants on the basis that they were not open on the applicable eligibility date, but they continued to be engaged in business activity and met the scheme eligibility criteria at that time, then they should be paid grants retrospectively for past periods of applicable restrictions. This does not apply to the three schemes that formally closed in 2020.

- Wedding Guidance Updated

The guidance for weddings has been updated to reflect the requirements of the national lockdown. The core guidance is:

You should only consider booking a wedding or civil partnership (or continuing with one that is already booked) in exceptional circumstances. This may be for example, if you or your partner is seriously ill and not expected to recover, or is to undergo debilitating treatment or life-changing surgery. Weddings and civil partnership ceremonies must only take place with up to 6 people. Anyone working is not included.

- Test and Trace Support Payment Updated

The guidance on receiving the £500 support payment if you are contacted by Test and Trace and told that you have to self-isolate has been updated to say that you can make a claim for the Test and Trace Support Payment scheme or a discretionary payment up to 28 days after the first day of your period of self-isolation.

- Treatment of Business Expenses Updated

HMRC’s guidance for employers on how to treat the provision of antigen test to staff for tax purposes has been updated. If the tests that you are providing your staff are outside of the government’s national testing scheme, either directly or by purchasing tests that are carried out by a third party, no Income Tax or Class 1A National Insurance contributions will be due. Similarly, employers and their employees will not be liable to any Income Tax or National Insurance contributions, where an employee receives money from their employer for obtaining a test.

Frequently Asked Questions - Tier 4 and January lockdown, FINAL, 20210115